GLD is the world's biggest repository of gold bars, if you remember the 'country of refiner origin' breakdown, this is the most recent snapshot (data is from a specific document issue - not an aggregate). I have also included the graphic to remind that we're only interested in the 400-oz variety.

And here is Julius Baer Gold Bars, with the countries in the same order as above. Let's be fair, their gold holdings are only a fraction of the size of GLD (but still a significant amount). The 'Global' represents a brand where the name is ambiguous - in this case, a single brand: "METALOR". Originally I thought these might be Metalor Hong Kong, but the serial numbers are not very similar to the Metalor HK bars (more study is needed here).

There are a few reasons I constructed this chart. First of all, you'll notice the higher comparative percentage of Swiss-refined bars which makes perfect sense - their vaults are located in Switzerland and geographically speaking, there will be more Swiss bars available. We also see less North American refiners here, compared with the vaults in London.

Anyway, the fact remains that (despite looking) we haven't found even one Chinese-Refined LBMA gold bar in a major ETF, which still lends support to the idea that China is holding onto its gold refinery output. This is supportive of Freegold theory, and also any other 'Chinese are keeping their Gold' narrative.To put it in perspective, this is a massive hurdle for anyone who still maintains that gold is just a commodity like the others - China has stuff pouring out of factories like a river including silver bars and other metals, so why should LBMA gold bars appear be absent from the list? (especially since we can safely assume they are being produced).

Although the data fits the story, are there any other explanations? In the spirit of discussion, I've tried to list some counter-arguments I can think of - and they are really, really weak - in fact I shall put forward arguments against my own suggestions. Feel free to put more forward, and we can add them to the list. Presented in order of likelihood. I wish I had some solid facts on the whereabouts of their gold, but we can only surmise. A listing of Chinese LBMA-gold accredited refineries can be seen here, and these are the ones we suspect are making lots of those 400oz gold

1. Geography Constrains Movement?: China is a long way away from the London Market and because gold moves around slower (than silver bars for example), not seeing any Chinese bars in America or Europe is perfectly acceptable - all the other bars have had decades to get to their current location. Perhaps the shipping and insurance against losses (pirates) is simply prohibitive and ETF demand can be met entirely with local stocks - as demonstrated in the Swiss-based ETF data above. So generally, we know this to be an existing effect, but we don't yet know the full extent. Against this idea: The number of shipping lanes in the modern world or the ability to get Fedex-style air deliveries within 24 hours if really wanted it - i.e. geography is not the problem that it used to be. Chinese are generally happy to sell in bulk at a razor-thin margin if it outbids other competitors - in theory the market for refinery output should receive equal treatment. ALSO: They seem to have no trouble shipping all the silver bars all the way to London!!! update: "...flying gold is relatively quick and cheap, and a lot cheaper on a % of metal value compares to shipping silver around" (ref: Bron Suchecki, in comments below).

2. Hong Kong is Chinas Gold???: In theory, because Hong Kong has such a small land area, most of it's gold refineries probably get gold from China, which may account for the high percentage of Hong Kong-refined gold, and absence of China. Against this idea: Still doesn't account for all the LBMA-gold accredited Chinese refiners output. Additionally, Hong Kong gold refineries have been operating for a while so most of those ETF bars are going to be old ones anyway (we'll get a better idea once we get a proper date/age/matching system going). update: additionally, Nick Lairds charts show that China is absorbing lots of HK refined gold as well ...

3. Comparatively Late Accreditation???: Most of the LBMA Gold-accredited refineries didn't get accredited until recently so there should be fewer bars compared with other refiners which have been supplying the market for decades. Against this idea: "The Great Wall Gold and Silver Refinery of China" which was LBMA accredited way back in 1981, plus, volume of recent output of Chinese Silver bars suggests those refiners have been really busy, with equivalent output, there should be a lot of Chinese gold bars.

4. Non-Acceptance of Bars???: Perhaps the ETF's prefer not to stock Chinese bars? After all is there not a general perception that Chinese are masters of the knock-off? Against this idea: These refiners are LBMA accredited, plus any fakes would be quickly discovered by the vaults. Silver bars are fine, why not gold? "Retail clients may not like Chinese bars but at the wholesale level no one cares" (ref: Bron Suchecki, in comments below)

5. The bars are being hoovered up by private Chinese investors???: Against this idea: No data at all on this wild conjecture! Not sure what the market would be for 400oz LBMA gold bars, but even if that were large then they would still be competing with the ETF's. Chinese prefer 1kg bars (ref: Bron Suchecki - also advanced by VtC in a previous thread).

------ this next set have been added based on the discussion in the comments below, which I will update in real time as I am able. I can't change the numbering above, so these are presented in the order they were presented. Attributions as indicated.

6. The Chinese are re-melting their bars into smaller 1kg bars??? (raised by

8f6d4ec6-3d96-11e1-bd2e-000bcdcb5194 as per Jim Willie's suggestion) This would certainly explain the absence of 400oz bars, and would be appropriate if China has ambition to alter the trading landscape (ref: Costata). Against this idea: Doing this would automatically exclude their gold from being used for international settlement, unless they plan to display so much clout as to overturn the established standard (which is possible). 'London Trader' is a dubious source, no backing data for the claim, financial institutions trade in 400oz bars as tradition/standard (as observed by Victor) and Chinese tend to follow, not lead. Rationale for having smaller-sized bars is also missing; would be a lot of effort and cost (but it's not like they are lacking the people to do it).

7. Chinese aren't producing London good delivery bars in large quantities??? (suggested by Costata in the Occam's Razor category) i.e. producing them, but not enough to get absorbed into the London Market. Potentially explains most scenarios and allows for normal geographic limitation effect Against this idea: They are producing large quantities of everything else, for all markets. If Chinese investors prefer 1kg bars, then they are not competing for the 400oz bars. Doesn't explain why we don't see at least 1 bar show up.

8. [added Dec-2012] Chinese Refiners receive an export incentive to export silver, but not gold. (sent to me via email from Bron) This would explain the metal ratio discrepancy - i.e. why we see lots of Chinese silver bars show up compared with gold; Against this idea: still doesn't account for the complete absence of gold bars.

9. [added Jan-2013] China is just one country among several whose output is not represented in the data. (suggested by Costata) In other words, China may not necessarily be unique in terms of the gold bars not showing up, and the focus on this particular country gives rise to bias. ... good suggestion and it's true - unfortunately would require a whole heap of other data to compare against. The only thing I can suggest against this idea is that this still doesn't account for all the other reasons why we ought to see at least one Chinese gold bar showing up - i.e. based on expected huge output volumes and Chinese merchants trying to undercut the global market, we should expect to see a few batches.

... and lots more great stuff in the comments below!

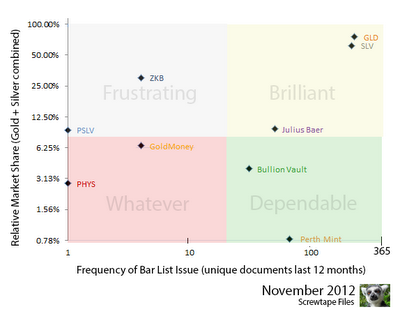

The second reason I wanted to show you Julius Baer summary is because it is one of the last few 'good' sources of data that we have left (and hence, not finding a Chinese Gold Bar in the current data, we're running out of data to check). Leaving the China topic briefly, I thought I would end with a graph I've been working on for a while - a way of charting the relevant 'quality' of a bar list input. This is my early chart design, which shows the comparative number of unique document issues projected against the comparative market share. The (compact) result is 4 distinct quadrants which determine how useful the data will be for analysis. Funds with both Silver and Gold have been normalized into a single expression of market share, and the scale on both axes is logarithmic (i.e. the graph is designed to highlight position only). This chart has a very specific bias - it only looks at the bar list documents as related to data warehousing utility.

|

| How well do you know the transparency of your chosen ETF? Positions on the chart are approximate, for illustrative purposes. |

Anything in the 'Whatever' quadrant has a very low market share, and very few unique documents being issued. We are not interested in these so much because they won't show a high resolution of change over time and not much inventory anyway. Goldmoney have now made their bar lists largely inaccessible so the point comes to figure out is it worth spending so much time chasing their data?

The 'Frustrating' quadrant is anything with a decently-high market share, but very few documents being created. It's no surprise that funds in this quadrant also have data issues - PSLV has incomplete data and the documents from ZKB do not list the Refiner Brand!!! (we can probably figure it out by matching the bar serial number patterns but it is very inprecise). For the most part these bar lists may otherwise have a lot of great and wonderful data, but we can't really put them to good use; hence, frustrating!

Anything in the 'Dependable' quadrant has a relatively high rate of document issue, but a low market share. We like these because even though they are small they give us a high resolution for changes, and generally speaking their attention to detail is HIGH - anything in this quadrant is generally reliable data and set an example for the other funds to aspire to.

The 'Brilliant' quadrant has the best of both worlds - huge inventory and lots of unique source documents being issued on a regular basis. It is no wonder these are the market leaders because they are well organized, and they are the most transparent because of the sheer volume of data on offer. Most of our studies from now on will focus solely on GLD and SLV exclusively because the other bar list document sources are simply not that significant by comparison.

Finally, there also don't appear to be any Vault Jumpers between Julius Baer and any of the other funds we have on record. This is odd, given the size of their Silver repository so I assume some kind of differences in the way they keep their data (I'll keep looking into this). There's only one last 'Brilliant' source of ETF bars data left to process in the great hunt for Chinese bars; the spreadsheets from ETF securities.

p.s. The graph above is evidence at how well Eric Sprott's social media advertising has worked - the bar lists backing his funds are among the worst in this categorization (my bias in this measurement already declared).

p.p.s. My praise for the big ETF's is not indicative of any specific endorsement; this is purely and simply a data warehousing exercise. Any anti-SLV and anti-GLD folk should be glad that so much good data is available since it gives us that much more rope to hang them with solid evidence for a level 1, 2 or 3 argument.

Updated: 20 November 2012 - to better demonstrate the 'Geography Isolation' effect, I thought it might be worth showing what the database has for Sprott's GOLD. Similar to the analysis on Sprott's Silver, he seems to have sourced the bulk of his gold from the Americas. Again, this appears to be an expression of cost of delivery and local stocks. Apologies I don't have the time to draw this up in a pretty graph - here's the raw output from PHYS:

|

| SPROTT's PHYS (latest) - 400oz Bar Refiner Origins by Country |

Update: 22 November 2012 - Dominic Frisby has just produced a more detailed writeup on the Hong Kong / China Gold relationship - it's well worth a read, in the context of what has been discussed here and also the research being done by Dominic, and of course to have a look at those charts that I mention in the comments (specifically, the 2010-2012 volume changes). His headline: 'Chinese Demand Could Send Gold Price Soaring'. Context: the charts originate from Nick Laird at www.sharelynx.com; the original data used for the charts is from this location http://www.censtatd.gov.hk/hkstat/sub/so230.jsp Regards, Warren

36 comments:

Well done. Quite some effort. This is certainly a site where they can't say it's "All wind and no Blow" which is more than be said for many of the Silver "conspiracy" sites.

Nicely done Warren.

Now I wonder who is buying the Chinese Silver? Refiners or ETF's? or both.

Not that I believe everything I read by Jim Willie, but this bit of conspiracy prose could provide some possible logic to your dilemma of the missing Chinese 400 oz bars.

CHINA RECASTS GOLD BARS

China is well along an ambitious plan to recast large gold bars into smaller 1-kg bars on a massive scale. A major event is brewing that will disrupt global trade and assuredly the global banking system. The big gold recast project points to the Chinese preparing for a new system of trade settlement. In the process they must be constructing a foundation for a possible new monetary system based in gold that supports the trade payments. Initally used for trade, it will later be used in banking. The USTBond will be shucked aside. Regard the Chinese project as preliminary to a collapse in the debt-based USDollar system. The Chinese are removing thousands of metric tons of gold bars from London, New York, and Switzerland. They are recasting the bars, no longer to bear weights in ounces, but rather kilograms. The larger Good Delivery bars are being reduced into 1-kg bars and stored in China. It is not clear whether the recast project is being done entirely in China, as some indication has come that Swiss foundries might be involved, since they have so much experience and capacity.

The story of recasting in London is confirmed by my best source. It seems patently clear that the Chinese are preparing for a new system for trade settlement system, to coincide with a new banking reserve system. They might make a sizeable portion of the new 1-kg bars available for retail investors and wealthy individuals in China. They will discard the toxic USTreasury Bond basis for banking. Two messages are unmistakable. A grand flipped bird (aka FU) is being given to the Western and British system of pounds and ounces and other queer ton measures. But perhaps something bigger is involved. Maybe a formal investigation of tungsten laced bars is being conducted in hidden manner. In early 2010, the issue of tungsten salted bars became a big story, obviously kept hush hush. The trails emanated from Fort Knox, as in pilferage of its inventory. The pathways extended through Panama in other routes known to the contraband crowd, that perverse trade of white powder known on the street as Horse & Blow, or Boy & Girl.

http://news.goldseek.com/GoldenJackass/1340820786.php

"The story of recasting in London is confirmed by my best source"

Unfortunately his best sources are Scooby Doo, Shaggy and probably John Macafee. Allegedly those guys are stoners and Bath Salt abusers.

Whilst I don't dismiss some of the things he says when he says they are theories. However, when he drags out his sources to back up his theories he does himself a disservice.

8f6d ...

Something makes it impossible for me to take anything Jim Willie says seriously.

Maybe it's the whiny high-pitched hysteria in his voice. I tried to listen to his GoldMoney podcast a few days ago, but had to switch it off when he started mewling about secret "multi-lateral, multi-nodal electronic money tunnels" that Russia, Germany and some other country are developing in secret.

A lot of these internet gold bugs sound like they're lying (even when they're not).

Schiff

Jim Willie

Embry (Sprott guy).

Eric King

Max Keiser

Why are their voices so shrill and grating?

@Louis, thanks! Yes, the LBMA-Silver accredited chinese refiners are pumping out silver bars like there is no tomorrow - the ETF holdings for Silver are approx. 20% Chinese origin (but there's other factors at work as well). This is one of the drivers for investigating the discrepancy - Silver 20%, Gold 0%, from the same companies. This is also the stake in the heart of the 'Geographic Isolation' argument, since we see BIG BATCHES of freshly minted LBMA silver 1000oz bars arrive in the London vaults regularly.

@duggo, thanks for the feedback. Yes, it takes ages to collate all this stuff. I don't claim to have all the answers, but we do have a large ore-body of raw data we can ask questions of. Just becomes a question of refining the output :)

UPDATE - I've added the 1kg bar argument as item #6, since (yes) it is a possible explanation, however as you can see there is not much which supports the idea .. primarily the fact that if China did want to use the gold for international settlement then they would use 400oz bars, rather than introducing their own standard. It is possibly that simple. Unless of course they turn around to the world and announce "Hey world, we have 20,000 tonnes of gold and as many nuclear missiles - we're floating our currency as a reserve - oh and BY THE WAY WE'RE USING METRIC, PLEASE REVERT. THANKYOU."

@Warren,

ask FOFOA if his readership includes the PBOC :)

Ask Bron about the form in which the Perth Mint ships their refined gold to HK/China.

SLL

"Perhaps the shipping and insurance against losses (pirates) is simply prohibitive"

Gold is never shipped, only flown. Way too easy to steal gold given its weight/size ratio compared to silver.

There is some case for geograph argument as simple economics means you don't want to move bars if you don't have to, which the difference between GLD and Julius shows. However I can't see this accounting for no Chinese bars in the ETFs as flying gold is relatively quick and cheap, and a lot cheaper on a % of metal value compared to shipping silver around.

"Non-Acceptance of Bars"

Retail clients may not like Chinese bars but at the wholesale level no one cares.

On points 5 & 6, 400oz bars are only used by central banks and ETFs and other pool backed type products. A lot of the gold in China is sold retail and refineries do not produce 400oz 99.5% bars and then melt them down or give 400oz bars to manufacturers/jewellers to melt down.

All of the stuff the Perth Mint sells to India and China distributors is 99.99% Kilo bars because this is a lot more convienent for jewellers and others to melt down and use to make jewellery or smaller bars.

The refineries in China would, just like us, make Kilo bars for supply to their domestic market.

Jim Willie and London Trader stories about 400oz bars being melted down into Kilo bars is just reflecting the fact that Chinese distributors prefer Kilo bar size for sale domestically. There is nothing surprising about this at all. We know there is a lot of Chinese demand for gold so I can see Swiss refineries getting 400oz bars out of London or Zurich and turning them into the size preferred by that market.

It does not reflect "the Chinese preparing for a new system of trade settlement" which is Jim taking an ordinary market behaviour and hyping it into some silly story to generate clicks.

FYI re China mine production, this has some interesting numbers http://www.bullionstreet.com/news/china-produces-288.2-tons-of-gold-till-sep-this-year/3391

"The ten largest gold firms produced 149 tonnes,47.3%, of the country's total output. China had more than 700 gold producers in 2009, down from more than 1,200 firms in 2002 as the industry consolidated."

Great sleuthing Warren.

(Bron weighed in while I was typing this comment. I just read his comments so I'll post mine with no changes.)

The Chinese bar issue is vexing. What does it mean? I think all theories should be entertained for now. Let's look for the simplest explanation we can find.

I haven't been following the HKMEX takeover of LME. I assume that it is proceeding. Given the huge inventories of commodities China is sitting on perhaps the plan is to shift the trade to Asia and use the LME as a branch office.

Creating a new 1kg standard would make sense if you wanted to establish new trading hubs for gold in Asia that are big enough to challenge London and other venues.

Trade settlement doesn't wash as an argument for China to produce 400 oz bars. They run a persistent trade surplus. Any flow of gold should be inward or lateral once the ownership of the gold changes hands i.e. transit through Switzerland to another destination.

So my contribution to the Occam's Razor competition is the Chinese aren't producing London good delivery bars in large quantities therefore they don't show up in Warren's bar list project.

(And they couldn't give a rat's arse about silver and that is why they are shipping in size to Western markets in standard "Western" bar sizes.)

I would also like to put this article on the table for discussion. Where is this gold coming from and where is it going to?

According to this report (my emphasis):

It is difficult to visualise the enormous quantity of gold that arrives in Switzerland every year. In 2011, over 2,600 metric tons of raw gold were imported into the country, to a total value of SFr96 billion ($103 billion). This was a record, the quantity having more than doubled over the last ten years, not including the gold that transits through Swiss free ports.

http://www.swissinfo.ch/eng/business/Switzerland:_the_world_s_gold_hub.html?cid=33706126

"Raw" gold? Perhaps Bron could give us a net figure for available raw gold after deducting all of the mint output worldwide. It might give us an insight into how much of the gold stock is flowing. I suppose it's possible this Swiss gold inflow is all mine supply and scrap.

But it makes me wonder if this is some kind of "money laundering" or 'anonymousing' or downsizing of 400 oz bars on a massive scale. Perhaps all three.

Eric Sprott claims that there is a shortage of gold being filled by central banks. So obviously we can discount this possibility. That leaves reprocessing IMHO. I'll leave you good people in peace now.

Cheers

http://usawatchdog.com/central-banks-gold-likely-gone-eric-sprott/

Thanks everyone for your great thoughts! I will keep updating the argument list in the main article as these items get raised.

We will also continue the data hunt for Chinese-refined gold 400oz bars, surely there has to be at least one??? ETF Securities data is next to process and they have over 6 million gold ounces (more than Julius Baer). Regards, Warren

The "raw gold" reference to 2,600t must be mine supply AND scrap as the Swiss don't refine all of the world's mine production!

There are 4 refineries in Switzerland so not surprising they have a lot of gold flowing. The other big ones are Rand and Perth Mint.

So I don't think those flows are anonymousing, just normal business for the Swiss.

I don't place much store in Eric's claim. First he simplifies the demand change and then ignores the fact that maybe "where it is all coming from" is the 140,000t above ground stock held by private investors and in jewellery (ie he assumes no one is selling) and therefore concludes it MUST BE from central banks.

@ Lord Sidcup

That's exactly how I feel about your list of "gurus"

Great minds think alike.

Jim Willie... during the silver spike I remember him saying the "dirty dozen," a group of wealthy Asian buyers that he is in contact with, were going to bust the Comex.

[updating my comment for clarity]

@freegoldfuturist, I've contacted Jim Willie asking him if those folk are the same as the Wynter Benton Group. Truth be told I am dying to know why these guys didn't show up for their price calling demo, specifically since there doesn't seem to have been any Global MF-style events lately which would account for their disappearance! Their price target of $50 silver by end of December seems attainable, but I doubt that anyone would ever attribute the price rise to their doing at this point.

p.s. all, I've just been looking at Nick Laird's charts for China/Hong Kong gold exports ... very interesting. big spikes in the last couple of years, with China getting a lot of refined gold from Hong Kong. This is a new chart from Sharelynx, Nick is using data from here. On the surface, this appears to nuke the 'Hong Kong is China's gold argument. I don't know what it all means but combined with everything else, it seems obvious there's a big FLOW of gold TO China. If the flow is currently in one direction then that more than accounts for the absence of LBMA gold bars. I imagine digging deeper will reveal a bit more, but I'm going to stick to my subject matter - which is bar list data - I'll leave the extrapolation to the experts.

"Silver Update 11/20/12 Massive Silver Suppression"

Another rant by BrotherJohn using the words of BullionBulls.

I'm becoming more and more convinced that "conspiracy" and "shortage" of Silver is just another fairy-tale like religion. There seems to be a connection between the people that specialise in Silver and religion. Ted Butler is like one of their "disciples". He writes something so the rest of the Silver gurus take it as gospel. A bit like the Bible.

Your evidence shows no shortage of Silver. It seems to me that the Silver sellers are only to happy to go along with the "shortage and smack-down" theory because it helps sales.

BullionVault never enters into this argument and have told me that they never have problems with Silver. Nor do Perth Mint. The only people that hint at problems are people like Sprott and people on King World News who are clever enough to promote their books.

I feel a silver post coming on. If Screwtape would like to host it let me know.

¡Give Uncle Costata the floor, por favor!

@costata - go on then. Send me your email address.

But don't go upsetting anyone, kicking hornets' nests, or ridiculing nonsense.

@costata, your thoughts on silver would be most welcome on this publishing platform - quite appropriate - most of us have followed your work in FOFOA's comment section.

JdA's email is via her blogger profile (you are possibly already in this process so I will not intefere). Regards, Warren

Screwtapers,

I'll draft an outline of what I have in mind and send it to JDA. The main aims of the post will be to upset everyone, kick hornets' nests and ridicule nonsense.

Thanks for the warm reception. BTW I should mention that publishing a post here isn't a slight to FOFOA. Many of the discussants at his blog are sick of the topic of silver. So I'm hoping the Screwtape audience will be more receptive to an "evil, lying scumbag"* like Uncle costata.

*The accolade comes from one of the legion of fans I attracted during the FOFOA blog silver open forums.

Besides I admire the impressive list of enemies you are making in the silver community. I feel I can make a modest contribution to expanding that list just by posting here since I'm kinda 'pre-loathed' among the silverbugs.

Can't help liking the Silverfuturist... zany!

His latest offering Bid vs Ask price on Kitco.

He makes some obvious points about Comex which are always dismissed by the Silver Bugs conspiracy.

http://www.youtube.com/watch?v=pDdhtG5moG4&list=UUBgYfi5EKCfD7ZJiIBDArSQ&index=1&feature=plcp

Warren,

I have an idea about the bar list project. I'm wondering how many other countries with LBMA approved refineries don't have any bars outside their borders. I don't know if, say, Russia has an LBMA approved refinery but if it does and there are no Russian bars in your database it might give us a hint about the "dark" flow.

I mention Russia because a couple of years back the Kremlin announced that they were cutting back their annual gold acquisition program to 100 m/t.

Annual production in Russia was claimed to be 180 m/t at the time so they clearly have a surplus available for export. Production should be increasing as well given the earlier successes in the Far East.

There's also Turkey to consider. Are there any Turkish bars in the system?

(as an aside: how's your silver post coming along, Mr Costata?)

@costata - it's a good question and something I've considered as part of this larger investigation (i.e. to not just single out China). I may be able to construct a graph showing those 'missing' spots.

It does get tricky because it would need to model elements (touched on here) such as local bullion supply and individual refiner output (yearly). Bron has explained to me that the refinery industry is incredibly guarded of their output information so good data is not readily had. Once we gather enough information however, we can begin to infer production volumes based on known sequences. For example, all we need to see is the start and end of a sequence and we can infer (using probability) all the bars in between [ Using the 'Trinity B. Wartime Tank Number Calculation Methodology' ].

Basically, yes - we can draw up a matrix of what we can't see vs. what is approximately expected vs. country production, but it will always be blurry resolution. We are all lucky that some independent researchers (Bron Suchecki, Nick Laird, Dominic Frisby) have given serious investigation into Chinese gold data recently.

re: Turkey. Of the 3 refiners detailed in the LBMA Gold list, we have records only for two. To be exact, there are 121 bars on record from those refiners, which tally to a grand 47,415 fine gold ounces (and no silver). Which is a tiny drop in the bucket compared with the ~ 100 million gold ounces inside the ETF/Depository system - so you might be onto something there, but we run into my point above: I don't know anything about Turkey's gold mining industry so I cannot comment on that.

Regards, Warren

... Russia has a lot of refineries, most of which are recently accredited (within the last 10-15 years).

Like China, they appear to have been supplying a lot of silver bars to the bullion market, but comparatively few gold bars - the 0.62% Russian inventory in the GLD list is wider defined from the database as as 870 gold bars (344,446 fine gold oz) which again is a fraction of the total in the market.

When we're looking at the data we ought to be aware that many of the bars in the ETF system have had decades in the system to propagate to their current location, an advanced version of the 'geographical argument' can also be at play - I hope to investigate this as there is time.

This 'dark inventory' question you speak of is the topic of my upcoming post, I've done the theory but I'm still collating the data for this investigation proper. It's a massive topic!! And very interesting.

Hi JDA,

I'm very slow with this kind of thing. I don't have FOFOA's natural ability. I'll try to get an outline to you next week.

I have a mountain of paperwork to get through as well at the moment and I'm procrastinating on that as well. So I really need to get offline and get on with it.

Cheers

Hi Warren,

Thanks for the feedback. I see you are on the case.

Even if the numbers are not precise I think we can draw some inferences that may be useful.

Interesting to see that both Russia and China are helping to relieve the silver shortage. The silverbugs should be giving these folks more love. In the post I may suggest that the silverbugs organize a group hug with them.

(Guinness Book of Records material for sure! And a giant step toward world peace as well.)

It also suggests a theme song for the silver post "Can You Feel The Love Tonight". I have to log off now I'm getting choked up just thinking about it.

Cheers

For the country refinery analysis you would also need to look at import/export figures in addition to domestic new mine production to get a handle on potential refinery output.

Warren,

Huge Kudos AGAIN! As a novice trying to understand all of this, I can't tell you how beneficial your work is regarding trying to ascertain the FACTS regarding PM flow. This is not to discount the work of all the other simians, but the bar list work is fantastic

Milamber

"Besides I admire the impressive list of enemies you are making in the silver community. I feel I can make a modest contribution to expanding that list just by posting here since I'm kinda 'pre-loathed' among the silverbugs."

Ahhahahahah.

I am starting to really like STF. Their growing list of enemies only raises their esteem in my eyes. :D

TF

Warren,

Is this of interest?

http://www.spdrgoldshares.com/media/GLD/file/Inspectorate_Certificate_Oct12_2011.pdf

Post a Comment